What is inflation, really?

❌ What they tell you:

"Inflation is a natural economic phenomenon where prices rise moderately over time, encouraging spending and investment, creating a healthy economy."

- Every economics textbook ever

✅ What it actually is:

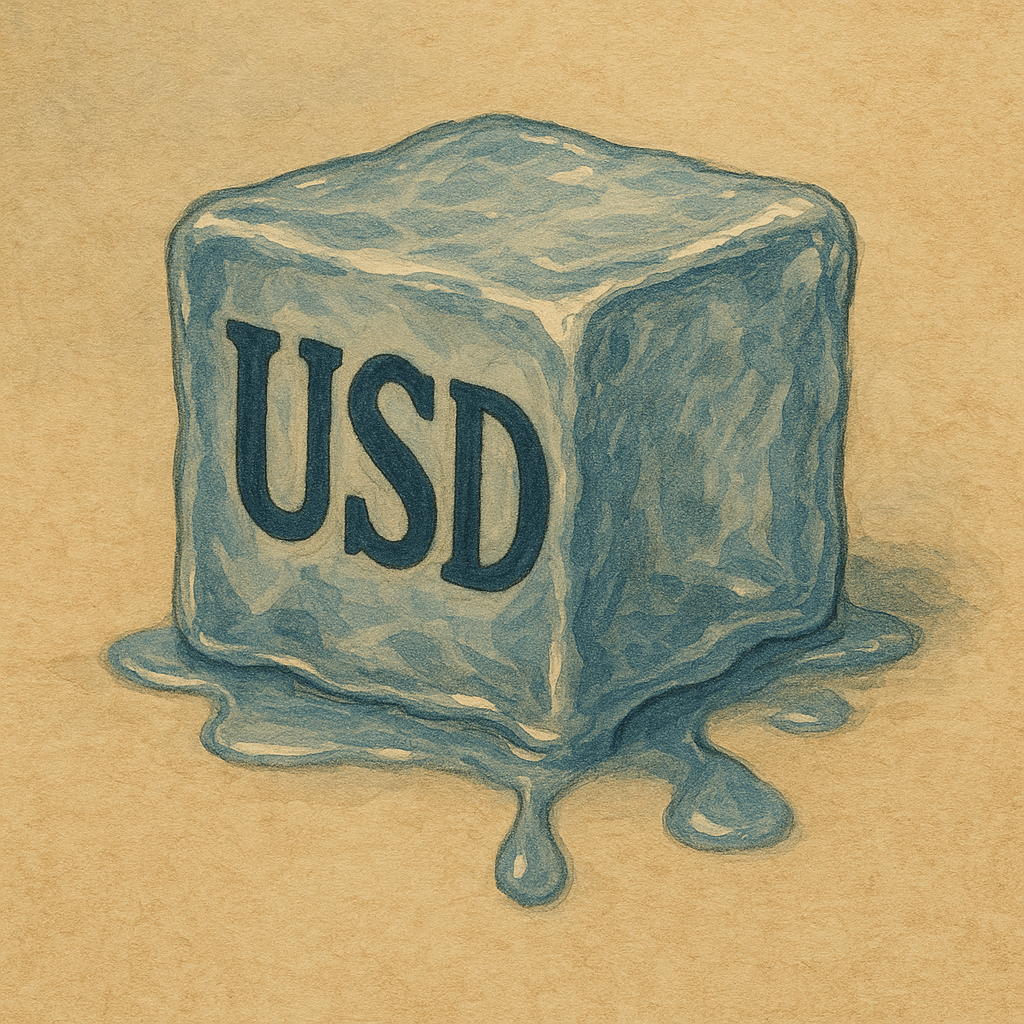

Inflation is the systematic debasement of currency through money printing.

It's not prices going up - it's your money becoming worth less. When the government prints trillions of new dollars, each existing dollar loses purchasing power. You're not getting poorer because things cost more; things cost more because your money is being diluted.

It's theft through dilution. Imagine you own 10% of all gold in existence. If someone could magically double the gold supply overnight, you'd now own only 5%. That's exactly what happens with fiat currency - except it happens every single day.

It's a hidden tax. The government doesn't need to raise taxes when they can simply print money and steal your purchasing power silently. You still have the same number in your bank account, but it buys less stuff. Taxation without legislation.

1. Money Creation

Central banks create money from nothing. Not backed by gold, silver, or any real value - just digits on a screen.

2. Supply Dilution

More dollars chasing the same goods = each dollar worth less. 40% of all USD ever created was printed in 2020-2021 alone.

3. Wealth Transfer

New money goes to banks & government first (Cantillon Effect). By the time it reaches you, prices already rose.

₿ The Bitcoin solution:

Absolute scarcity

21 million bitcoin. No more, ever. No government, corporation, or individual can print more. True digital scarcity enforced by code, not promises.

Deflationary by design

As demand grows and supply stays fixed, each bitcoin becomes more valuable. Your savings grow in purchasing power instead of melting away.

"Inflation is taxation without representation."

Bitcoin is representation without taxation.